Digital SME Onboarding as a service

Offer your new SME customers the best possible user experience for Onboarding and position your bank as a digital leader.

OnSite

Online

Trusted by

Process sme onboarding

Open an account in just 6 steps

01

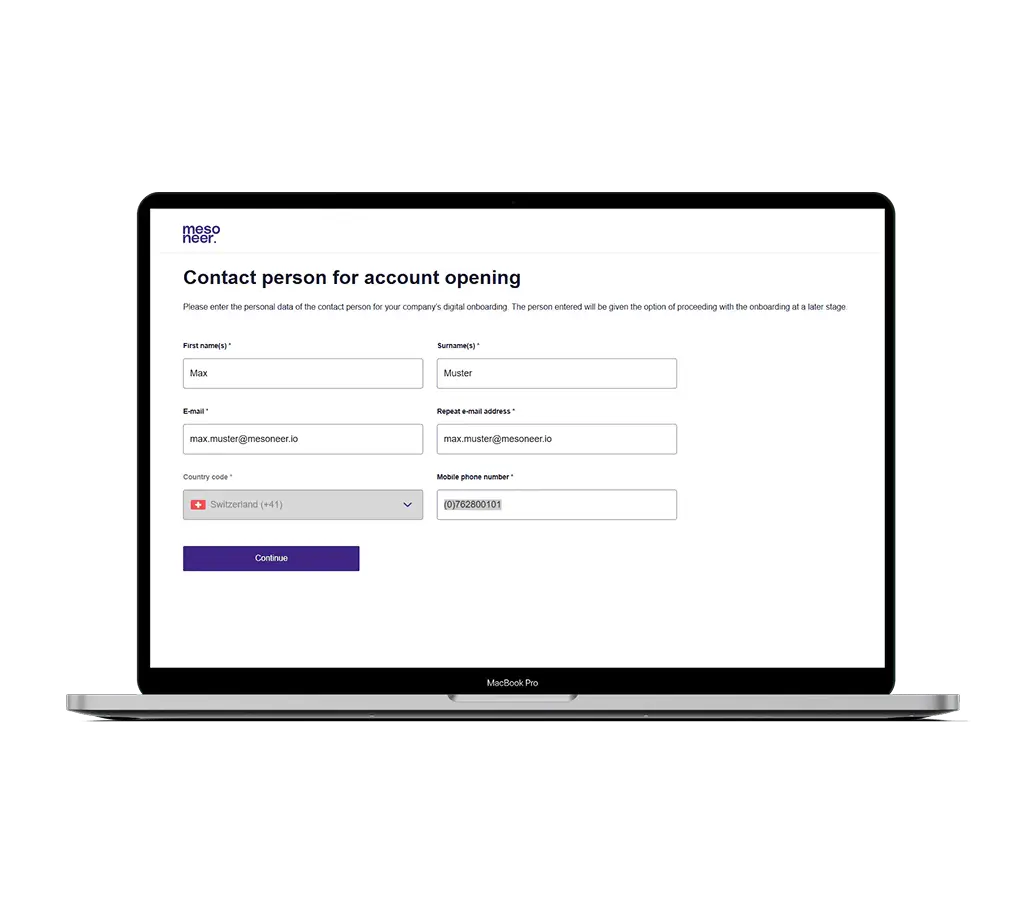

Contact person

Enter contact person for onboarding

02

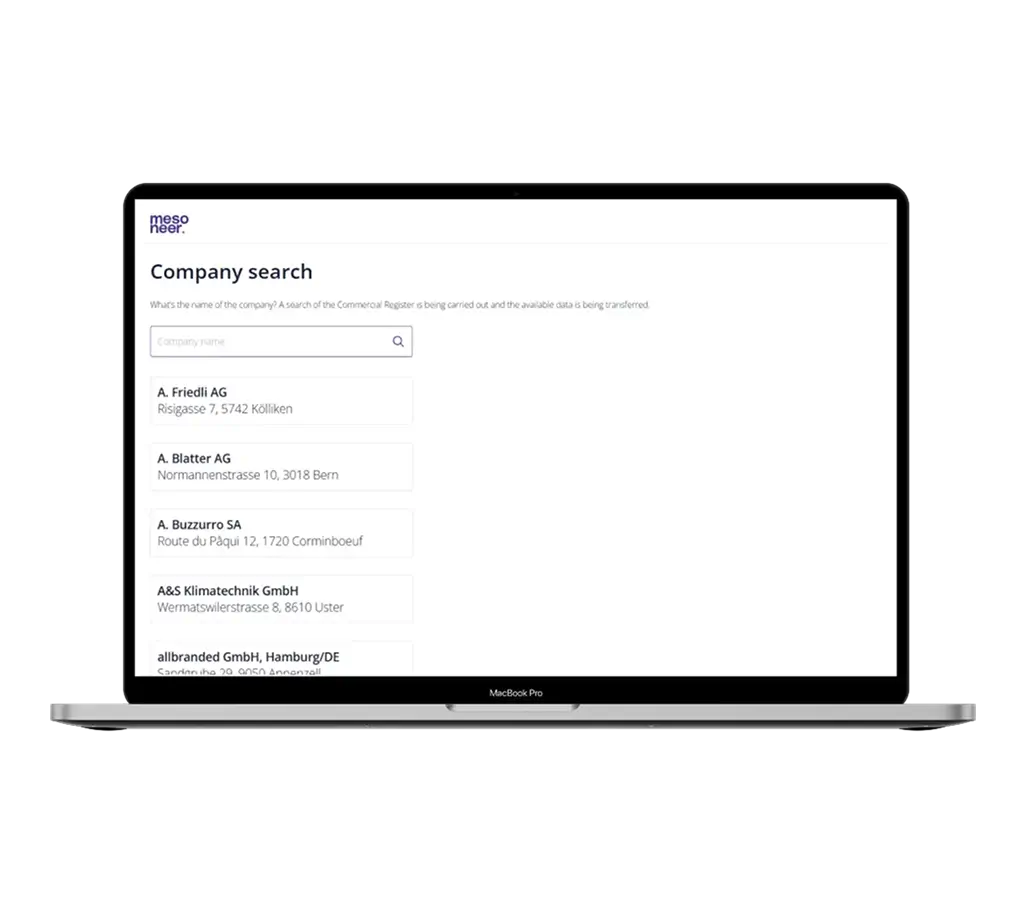

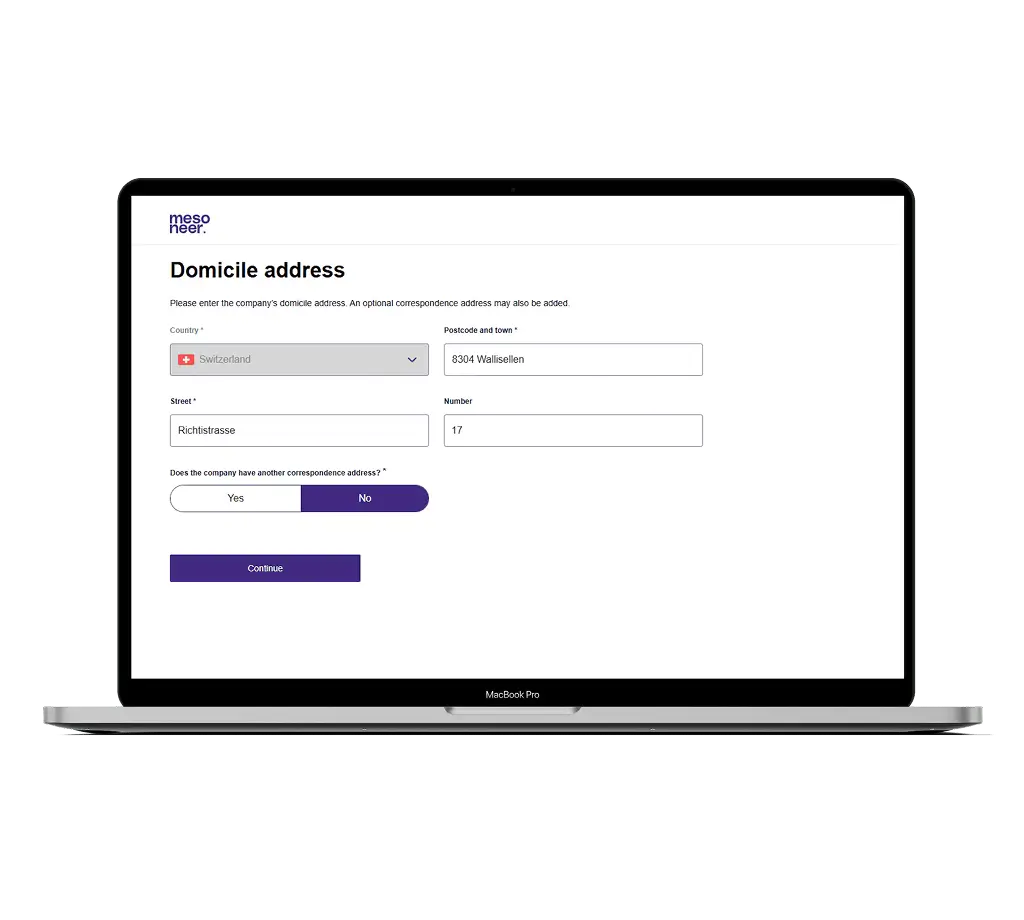

Company information

Query of the company in the commercial register with automatic data transfer. Complete missing information manually.

03

Legal questions

Answer legal questions regarding compliance requirements.

04

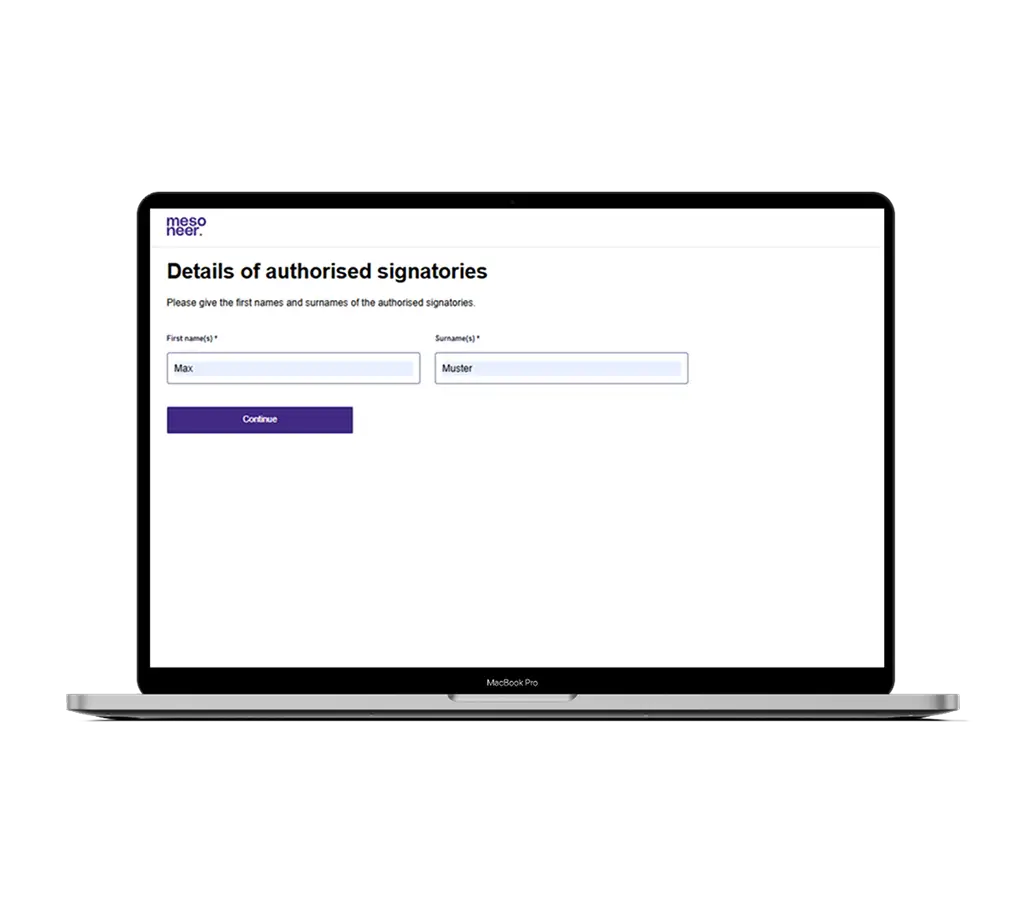

Authorised signatories and control holders

Select the authorized signatories and the supervisory bodies. Existing data from the commercial register is automatically displayed for selection.

05

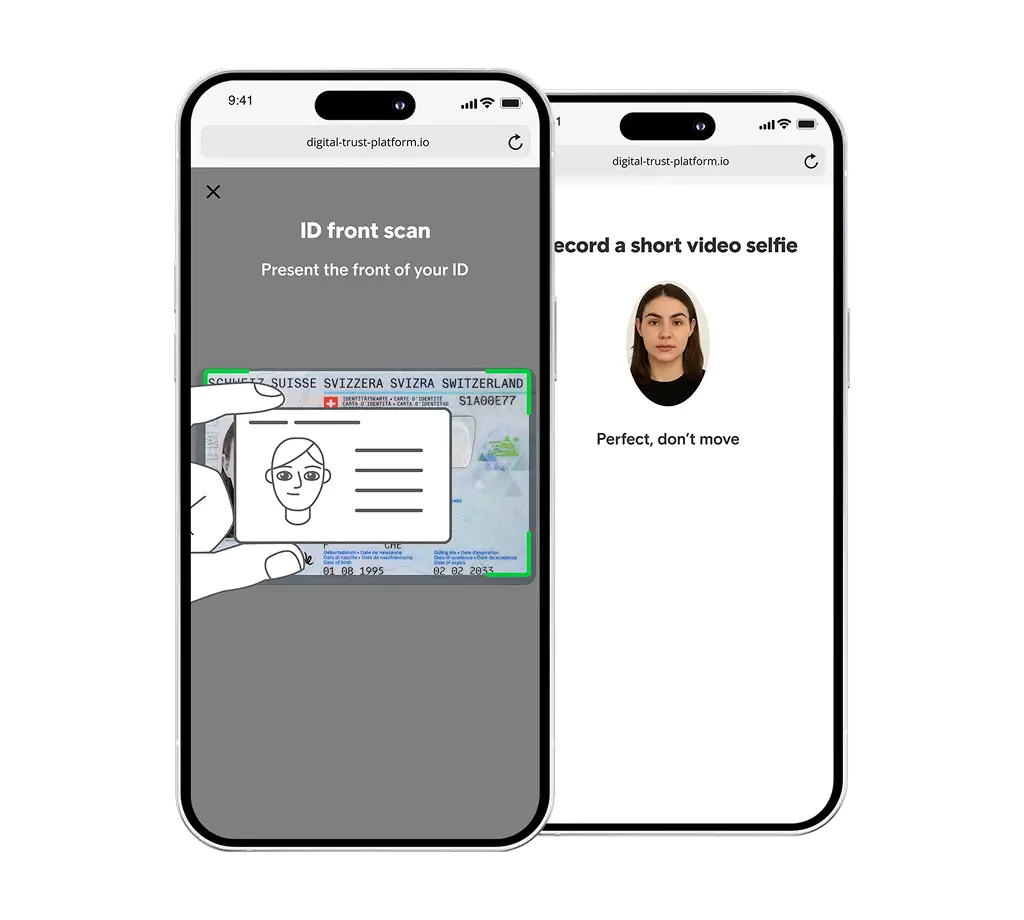

Digital identification and signature

The authorized signatories receive a link by e-mail to digitally identify and sign the documents.

06

Open account and get started

Once the document have been signed by everyone, the bank can complete the onboarding process.

Use cases digital client onboarding

Use Cases for mesoneer’s Digital Client Onboarding Suite

On-site Onboarding

Personal and modern

Paperless

Immediate Product Origination

Self Onboarding

Mobile first UX

Accessible anytime, anywhere

Immediate Product origination

Features

Most important features

Customization

The application supports multiple tenants and therefore allows bank-specific adaptations. These include the following customizations:

Branding per client

Product configuration incl. description, criteria, product bundles with several products as well as the configuration of additional products such as e-banking and cards

Legal information and exclusion criteria

Automatic reminders

Bank-specific components

Connection to commercial register

During the onboarding process, the applying company can be selected in the commercial register. The relevant data is automatically transferred and can then be completed. Sole proprietorships that are not listed in the commercial register are also permitted and can be entered manually.

Digital identification and signatures

The integration of m_IDeal makes it easy for people to identify themselves digitally – securely and in compliance with the Anti-Money Laundering Act (AMLA). The generated documents can then be signed in one go with a qualified electronic signature (QES).

Digital Trust Platdorm

Validating addresses

Both the addresses of the authorized representatives and those of the specified supervisory authorities are validated using a linked address service.

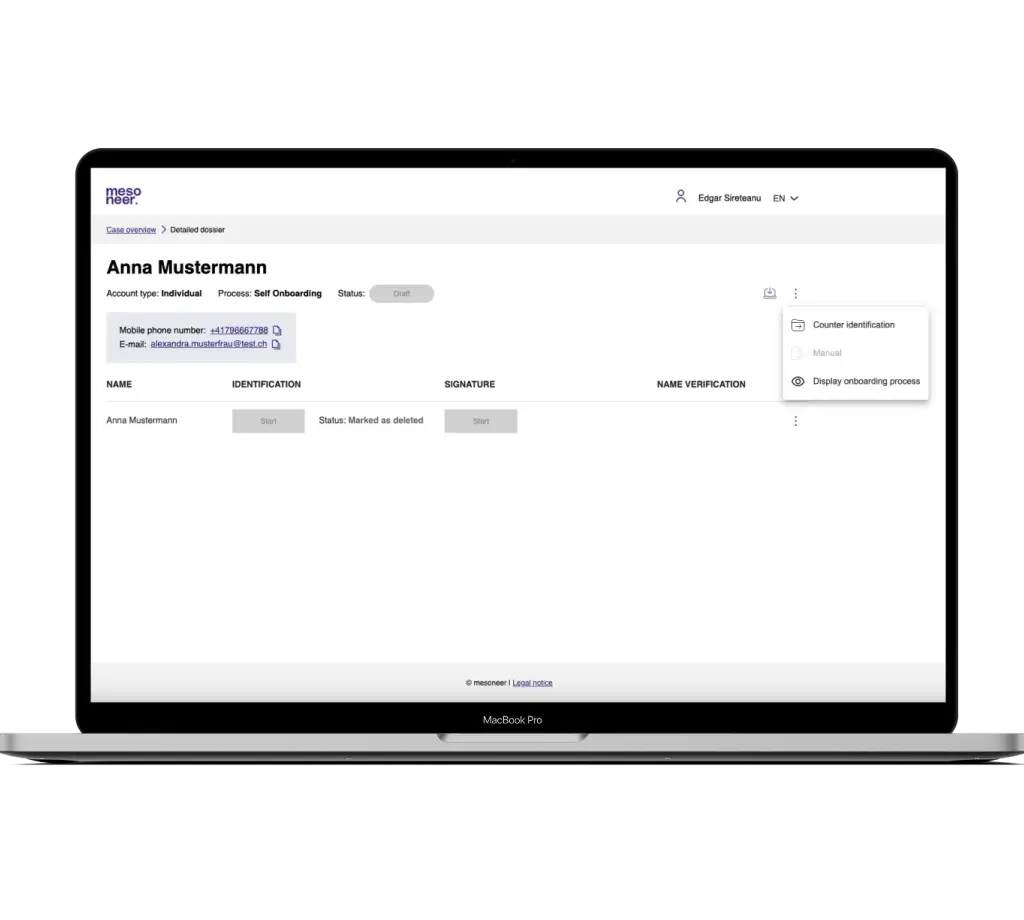

Keeping track with the dashboard

The application's dashboard simplifies the further processing of incoming onboarding cases and thus supports the back office.

Users of the bank can access the dashboard via personal login.

Overview of current and closed cases.

Detail view of the individual onboarding cases.

Channel change from "on-site" to "online" and vice versa for identification and signature.

Creating a new guided onboarding case.

Export of data of completed cases including signed basic contract, identification information and json file containing the recorded data for further processing in internal bank systems.

INSPIRATION

Inspiration for your next AI project

Easy to use

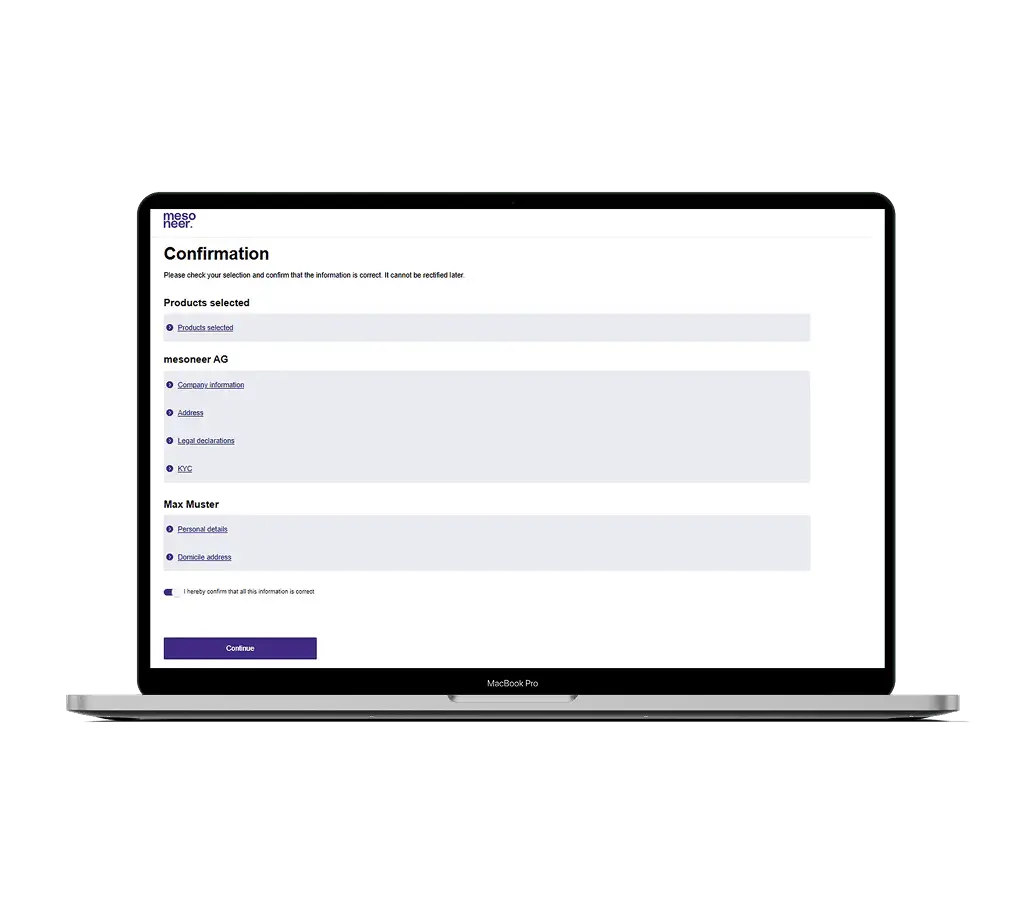

With this intuitive solution, you can open a bank account in just a few steps. Displaying the progress of the process makes it even easier to find your way through.

Improved data quality

The transfer of data from onboarding ensures high data quality and minimizes errors. This makes it much easier to process the cases in the back office.

Always available

The solution allows you to always be there for new customers - no matter when and where.

Integration Possible

mesoneer offers the optional connection to third-party systems such as core banking, CRM and archives, but does not require a connection to internal banking systems. All data can be processed directly via the export function.

Saas solution

As a SaaS solution, the onboarding solution is fully operated and maintained by mesoneer. However, the entire operation or parts of it can optionally also be carried out on-premise.

Ready to use

mesoneer's digital onboarding as a service is configured in no time and quickly ready for use – without the risk of a large-scale project.

Blog

Everything about Private Client Onboarding

.webp)

Digital Onboarding

,

Electronic Signature

,

Online identification with qualified electronic signature

New online identification using both passport and identity card for contract closures with high compliance requirements.

Digital Onboarding

,

Electronic Signature

,

New digital onboarding solution for the ESPRIT network

The IT service provider for banks and financial service providers ESPRIT Netzwerk AG launched its new digital onboarding solution from software manufacturer mesoneer AG this week. The application supports use cases for self-onboarding and guided onboarding in bank branches and covers both natural and legal persons. Thanks to mesoneer's own digital identification solution, which is directly integrated into the onboarding solution, the onboarding process remains convenient at all times and also complies with the necessary regulatory requirements. Six banks in the ESPRIT network are currently planning to switch to the new solution, although the application is also open to other banks in the network thanks to its multi-client capability.

Electronic Signature

,

Digital Onboarding

,

Digital identification with QES: not just an opportunity, but a necessity

Auto identification now also opens up further opportunities in the Swiss financial sector to improve the security and efficiency of digital identification and signature processes. However, considering new technologies such as deep fakes, secure identification will also become increasingly important in other areas in the future.

View All

contact

Your Direct Line to mesoneer

Do you have questions about our solutions or are you looking for a software company for your next project? Get in touch with mesoneer – we are happy to advise you.